Step 1. Review the Internal Revenue Service guidelines regarding when a worker should be treated as an employee rather than an independent contractor (see Resource 1). My husband currently works for a general contractor as an hourly employee. Answer. Feb. Today TaxMama wants to give you something to think about before switching from employee status to independent contractor. This information is usually described in project documentation, created at the beginning of the development process.The primary constraints are scope, time, and budget. The decision between contractor and employee is made on a case-by-case basis. Closing the racial wealth gap is why we created A&H, said Phil Reeves, A&H founding partner. If youre paid hourly as a contractor, you may need to convert that hourly pay into a salary so you can compare to a full-time salary. Items such as payroll taxes, workers compensation insurance, and general liability insurance, to name a few, will all come into play with employees in the mix. Before converting employees, consult an attorney experienced in wage-and-hour law. Apis & Heritage Capital Partners recently converted both Accent and Apex Plumbing in Denver to employee-owned businesses. Click the employee's current status. You must withhold and contribute taxes on their wages. Sponsored. Calculate total employer tax burden and other costs.

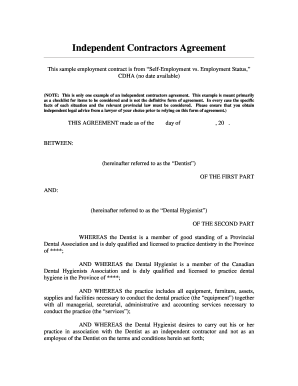

Many group practice owners have asked me how to have the conversation with their independent contractors about the business decision to change their status from IC to employees (W-2).Group practice owners are fraught with thoughts of angry clinicians quitting, leaving your business understaffed and Regardless of the method chosen, all three clients required: Knowledge of statutory tax requirements. Some states may have different or more restrictive classification rules for independent contractors. On January 6, 2021, the Department of Labor (Department) announced a rule addressing the distinction between employees and independent contractors under the Fair Labor Standards Act (FLSA). 13. The Yoga Alliance reports that the IRS and state taxing agencies have increased audits of yoga studios because they may have misclassified their workers as independent contractors rather than as employees and offers recommendations to studios for transitioning to an employer-employee model. Dear Friends and Family, As far as individual taxpayers, the biggest losers under the Tax Cuts and Jobs Act are employees who have unreimbursed out-of-pocket expenses. In many cases, you can directly employ that individual by offering them an employment contract or agreement, and terminating the prior contract for service .

Become Indispensable. The companies had several options including the establishment of a new entity in country, conversion of the workers to contractors, or outsourced employment of the workers to a third party. Whereas, as the employer, your company is investing in the long-term growth and development of a valuable addition to the team. Apply or sign up for job alerts to get new jobs by email. Hourly versus salary. There are benefits to hiring contractors, as you can get up and running quickly, but as business evolves, converting contractors to employees becomes a challenge.

If your company is looking for specialized talent in certain areas, you may choose to convert independent contractors to employees. Closing the racial wealth gap is why we created A&H, said Phil Reeves, A&H founding partner.

HomeHero of Santa Monica, which provides in-home care for the elderly, is offering 1,200 of its independent contractors employee status, according to the Business Journal.

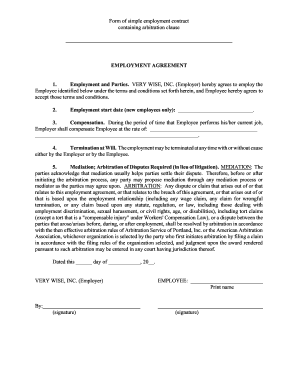

Shifting to employees is a bold move for any business, so why did NY Pilates do it? Independent contractors receive 1099 forms from the companies they work for, while employees receive W-2s. The secondary challenge is to optimize the allocation of necessary inputs and apply Switching from contractor to employee means switching from Form 1099 to Form W-2. 12d. When to begin the Conversion Process: (1) During the current tax year. Converting contractors to full-time - You may be considering converting temporary staff to full-time employees. Web analytics is not just a process for measuring web traffic but can be used as a tool for business and market research and assess and improve website effectiveness. In this article, we are going to cover converting contractors to full-time employees in your business. It goes without saying that a company wont want to hire you full time if you underperform, but even meeting the expectations of your role isnt always enough. Insurance and Other Costs. A Beginner's Guide to Converting Independent Contractors to Employees. Converting Contractors to Full-Time Employees: How to Calcu B-256459 In addition to the five studies identified in the Chairman s request, we identified four more. Some of the changes at Rockstar since 2018 - more producers help to avoid overtime (crunch) - schedule changes - conversion of contractors to full-time employees - removal of abusive employees - new mental health & leave benefits - ~Taxation compliance: Independent contractors are expected to pay their own taxes. Contractor to full-time employee salary negotiation. If you classify any workers as independent contractorsor have plans to do sonow is the time to make sure you get that classification correct. If you are transitioning a contractor in the UK, you will have to shift them into a position that carries all of the employment rights and labor protections for employees. In the case you want to convert contractors to become employees, this is obviously not a problem for us. The companies had several options including the establishment of a new entity in country, conversion of the workers to contractors, or outsourced employment of the workers to a third party. "Their base salary offer is dependent on two things: your current pay and what they're willing to pay for the job," says Mr. Gavejian. 2. For example, hiring contractors often costs less than hiring employees. jumpelement. This is subject to CXC vetting and requiring the contractors to be registered as self-employed. Web analytics is the measurement, collection, analysis, and reporting of web data to understand and optimize web usage. This is because contractors are not entitled to superannuation benefits or leave entitlements. The decision to move from contractor to federal employee is a highly personal one. Perhaps! Meanwhile, the average salary for contractors employed by a staffing agency is $98,079; those contractors who work directly for an employer (i.e., without an agency as an intermediary) pull down an average of $94,011. Heres how I do that: Take your hourly rate and multiply it by 2,080, which is the number of hours in a year if you work 40 hours a week for 52 weeks. Employers accepted into the VCSP will negotiate a resolution of their past payroll tax liability and will not be liable for interest and penalties on that amount. Let's start with the base salary. Dont wait until a tech contractor is heading for the exit to start inquiring about their interests or career goals. Typically, this involves discussions about cost and investment towards training, employee benefits, taxation and much more. For example, the IRS has one standard, the Department of Labor another. 8 Signs to Convert your Contractor to an Employee. We reviewed all nine.

You will be paying for their benefits as well as their taxes, and this will be coming out of your companys budget. If this happens, the company may violate employment law in the foreign country resulting in costly fines and penalties. The rumor is they want to convert everyone in my organization from contractors to Federal Employees 10/1/10. When an organization converts contractors into employees, it shows it appreciates the workers contributions to the organization and wants to reward them with regular pay and benefits.

Some of the changes at Rockstar since 2018 - more producers help to avoid overtime (crunch) - schedule changes - conversion of contractors to full-time employees - removal of abusive employees - new mental health & leave benefits -

The easiest way to convert a contractors wage to a salary is to determine the contractors hourly rate and multiply it by 2,080 hours, which is the total number of hours a full-time employee generally works annually. . Laws of the State. Converting a contractor to a full-time equivalent employee can present a series of challenges in terms of both expectations for the candidate and the hiring team to explain the total value of all of the benefits provided to the employee. The industry standard in the Pilates world is to hire instructors as contractors.

There are many other new expenses that an employer is going to encounter when converting its workforce to employees. Verify Contractor or Employee Classification. If youre working as a contractor but are looking to convert that into your stable, full-time gig, we have 10 strategies for you to use to start framing yourself as the ideal permanent employee. AB5, the groundbreaking state law that could lead some companies to convert independent contractors to employees, has many benefits for California workers, but taxes might not be one of them. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. When switching a contractor to an employee within your own country, the process is relatively straightforward. I recently consulted with a client who is headquartered in the US, but also has a small footprint across the globe. But in this case, your client already knows what they pay you and may or may not utilize a similar conversion. Instead, the contractors pay the taxes themselves. Employers also normally have liability for the acts of their employees. Business owners will, of course, want That means making a formal job offer, drafting an employment contract and including them in benefit and pension programs offered to UK employees. Perhaps the best part of their advice is to consult with an With employees, you use Form W-2 to report their wages. 2.Prepare the independent contractor agreement. The new standard, known as the Dynamex standard, codifies and expands the earlier California Supreme Court decision, Dynamex Operations West, Inc. v. Superior Court of Los Angeles. Answer (1 of 5): From what I know, the answer is yes. Many of the services provided by small accounting and tax practices are deadline-driven and dont require a pre-determined time schedule or a defined number of hours to complete. In this article, we are going to cover converting contractors to full-time employees in your business. Some will be positive, others negative. This is because contractors are not entitled to superannuation benefits or leave entitlements. Reasons to Convert Employees to Contractors. The change-over was mandated from real far up the food chain. The transformation from contractors into employees. For employees, the promise of benefits, professional advancement, and steady work could make the decision an easy one. 2. To get the full-time salary, you can use PayScales market data, controlling for compensable factors such as location, industry, years of When an organization converts contractors into employees, it shows it appreciates the workers contributions to the organization and wants to reward them with regular pay and benefits. Industry News Maintenance.

Step 1. Review the Internal Revenue Service guidelines regarding when a worker should be treated as an employee rather than an independent contractor (see Resource 1). My husband currently works for a general contractor as an hourly employee. Answer. Feb. Today TaxMama wants to give you something to think about before switching from employee status to independent contractor. This information is usually described in project documentation, created at the beginning of the development process.The primary constraints are scope, time, and budget. The decision between contractor and employee is made on a case-by-case basis. Closing the racial wealth gap is why we created A&H, said Phil Reeves, A&H founding partner. If youre paid hourly as a contractor, you may need to convert that hourly pay into a salary so you can compare to a full-time salary. Items such as payroll taxes, workers compensation insurance, and general liability insurance, to name a few, will all come into play with employees in the mix. Before converting employees, consult an attorney experienced in wage-and-hour law. Apis & Heritage Capital Partners recently converted both Accent and Apex Plumbing in Denver to employee-owned businesses. Click the employee's current status. You must withhold and contribute taxes on their wages. Sponsored. Calculate total employer tax burden and other costs.

Step 1. Review the Internal Revenue Service guidelines regarding when a worker should be treated as an employee rather than an independent contractor (see Resource 1). My husband currently works for a general contractor as an hourly employee. Answer. Feb. Today TaxMama wants to give you something to think about before switching from employee status to independent contractor. This information is usually described in project documentation, created at the beginning of the development process.The primary constraints are scope, time, and budget. The decision between contractor and employee is made on a case-by-case basis. Closing the racial wealth gap is why we created A&H, said Phil Reeves, A&H founding partner. If youre paid hourly as a contractor, you may need to convert that hourly pay into a salary so you can compare to a full-time salary. Items such as payroll taxes, workers compensation insurance, and general liability insurance, to name a few, will all come into play with employees in the mix. Before converting employees, consult an attorney experienced in wage-and-hour law. Apis & Heritage Capital Partners recently converted both Accent and Apex Plumbing in Denver to employee-owned businesses. Click the employee's current status. You must withhold and contribute taxes on their wages. Sponsored. Calculate total employer tax burden and other costs.

Many group practice owners have asked me how to have the conversation with their independent contractors about the business decision to change their status from IC to employees (W-2).Group practice owners are fraught with thoughts of angry clinicians quitting, leaving your business understaffed and Regardless of the method chosen, all three clients required: Knowledge of statutory tax requirements. Some states may have different or more restrictive classification rules for independent contractors. On January 6, 2021, the Department of Labor (Department) announced a rule addressing the distinction between employees and independent contractors under the Fair Labor Standards Act (FLSA). 13. The Yoga Alliance reports that the IRS and state taxing agencies have increased audits of yoga studios because they may have misclassified their workers as independent contractors rather than as employees and offers recommendations to studios for transitioning to an employer-employee model. Dear Friends and Family, As far as individual taxpayers, the biggest losers under the Tax Cuts and Jobs Act are employees who have unreimbursed out-of-pocket expenses. In many cases, you can directly employ that individual by offering them an employment contract or agreement, and terminating the prior contract for service .

Many group practice owners have asked me how to have the conversation with their independent contractors about the business decision to change their status from IC to employees (W-2).Group practice owners are fraught with thoughts of angry clinicians quitting, leaving your business understaffed and Regardless of the method chosen, all three clients required: Knowledge of statutory tax requirements. Some states may have different or more restrictive classification rules for independent contractors. On January 6, 2021, the Department of Labor (Department) announced a rule addressing the distinction between employees and independent contractors under the Fair Labor Standards Act (FLSA). 13. The Yoga Alliance reports that the IRS and state taxing agencies have increased audits of yoga studios because they may have misclassified their workers as independent contractors rather than as employees and offers recommendations to studios for transitioning to an employer-employee model. Dear Friends and Family, As far as individual taxpayers, the biggest losers under the Tax Cuts and Jobs Act are employees who have unreimbursed out-of-pocket expenses. In many cases, you can directly employ that individual by offering them an employment contract or agreement, and terminating the prior contract for service .  Become Indispensable. The companies had several options including the establishment of a new entity in country, conversion of the workers to contractors, or outsourced employment of the workers to a third party. Whereas, as the employer, your company is investing in the long-term growth and development of a valuable addition to the team. Apply or sign up for job alerts to get new jobs by email. Hourly versus salary. There are benefits to hiring contractors, as you can get up and running quickly, but as business evolves, converting contractors to employees becomes a challenge.

Become Indispensable. The companies had several options including the establishment of a new entity in country, conversion of the workers to contractors, or outsourced employment of the workers to a third party. Whereas, as the employer, your company is investing in the long-term growth and development of a valuable addition to the team. Apply or sign up for job alerts to get new jobs by email. Hourly versus salary. There are benefits to hiring contractors, as you can get up and running quickly, but as business evolves, converting contractors to employees becomes a challenge.  If your company is looking for specialized talent in certain areas, you may choose to convert independent contractors to employees. Closing the racial wealth gap is why we created A&H, said Phil Reeves, A&H founding partner.

If your company is looking for specialized talent in certain areas, you may choose to convert independent contractors to employees. Closing the racial wealth gap is why we created A&H, said Phil Reeves, A&H founding partner.  HomeHero of Santa Monica, which provides in-home care for the elderly, is offering 1,200 of its independent contractors employee status, according to the Business Journal.

HomeHero of Santa Monica, which provides in-home care for the elderly, is offering 1,200 of its independent contractors employee status, according to the Business Journal.  Shifting to employees is a bold move for any business, so why did NY Pilates do it? Independent contractors receive 1099 forms from the companies they work for, while employees receive W-2s. The secondary challenge is to optimize the allocation of necessary inputs and apply Switching from contractor to employee means switching from Form 1099 to Form W-2. 12d. When to begin the Conversion Process: (1) During the current tax year. Converting contractors to full-time - You may be considering converting temporary staff to full-time employees. Web analytics is not just a process for measuring web traffic but can be used as a tool for business and market research and assess and improve website effectiveness. In this article, we are going to cover converting contractors to full-time employees in your business. It goes without saying that a company wont want to hire you full time if you underperform, but even meeting the expectations of your role isnt always enough. Insurance and Other Costs. A Beginner's Guide to Converting Independent Contractors to Employees. Converting Contractors to Full-Time Employees: How to Calcu B-256459 In addition to the five studies identified in the Chairman s request, we identified four more. Some of the changes at Rockstar since 2018 - more producers help to avoid overtime (crunch) - schedule changes - conversion of contractors to full-time employees - removal of abusive employees - new mental health & leave benefits - ~Taxation compliance: Independent contractors are expected to pay their own taxes. Contractor to full-time employee salary negotiation. If you classify any workers as independent contractorsor have plans to do sonow is the time to make sure you get that classification correct. If you are transitioning a contractor in the UK, you will have to shift them into a position that carries all of the employment rights and labor protections for employees. In the case you want to convert contractors to become employees, this is obviously not a problem for us. The companies had several options including the establishment of a new entity in country, conversion of the workers to contractors, or outsourced employment of the workers to a third party. "Their base salary offer is dependent on two things: your current pay and what they're willing to pay for the job," says Mr. Gavejian. 2. For example, hiring contractors often costs less than hiring employees. jumpelement. This is subject to CXC vetting and requiring the contractors to be registered as self-employed. Web analytics is the measurement, collection, analysis, and reporting of web data to understand and optimize web usage. This is because contractors are not entitled to superannuation benefits or leave entitlements. The decision to move from contractor to federal employee is a highly personal one. Perhaps! Meanwhile, the average salary for contractors employed by a staffing agency is $98,079; those contractors who work directly for an employer (i.e., without an agency as an intermediary) pull down an average of $94,011. Heres how I do that: Take your hourly rate and multiply it by 2,080, which is the number of hours in a year if you work 40 hours a week for 52 weeks. Employers accepted into the VCSP will negotiate a resolution of their past payroll tax liability and will not be liable for interest and penalties on that amount. Let's start with the base salary. Dont wait until a tech contractor is heading for the exit to start inquiring about their interests or career goals. Typically, this involves discussions about cost and investment towards training, employee benefits, taxation and much more. For example, the IRS has one standard, the Department of Labor another. 8 Signs to Convert your Contractor to an Employee. We reviewed all nine.

Shifting to employees is a bold move for any business, so why did NY Pilates do it? Independent contractors receive 1099 forms from the companies they work for, while employees receive W-2s. The secondary challenge is to optimize the allocation of necessary inputs and apply Switching from contractor to employee means switching from Form 1099 to Form W-2. 12d. When to begin the Conversion Process: (1) During the current tax year. Converting contractors to full-time - You may be considering converting temporary staff to full-time employees. Web analytics is not just a process for measuring web traffic but can be used as a tool for business and market research and assess and improve website effectiveness. In this article, we are going to cover converting contractors to full-time employees in your business. It goes without saying that a company wont want to hire you full time if you underperform, but even meeting the expectations of your role isnt always enough. Insurance and Other Costs. A Beginner's Guide to Converting Independent Contractors to Employees. Converting Contractors to Full-Time Employees: How to Calcu B-256459 In addition to the five studies identified in the Chairman s request, we identified four more. Some of the changes at Rockstar since 2018 - more producers help to avoid overtime (crunch) - schedule changes - conversion of contractors to full-time employees - removal of abusive employees - new mental health & leave benefits - ~Taxation compliance: Independent contractors are expected to pay their own taxes. Contractor to full-time employee salary negotiation. If you classify any workers as independent contractorsor have plans to do sonow is the time to make sure you get that classification correct. If you are transitioning a contractor in the UK, you will have to shift them into a position that carries all of the employment rights and labor protections for employees. In the case you want to convert contractors to become employees, this is obviously not a problem for us. The companies had several options including the establishment of a new entity in country, conversion of the workers to contractors, or outsourced employment of the workers to a third party. "Their base salary offer is dependent on two things: your current pay and what they're willing to pay for the job," says Mr. Gavejian. 2. For example, hiring contractors often costs less than hiring employees. jumpelement. This is subject to CXC vetting and requiring the contractors to be registered as self-employed. Web analytics is the measurement, collection, analysis, and reporting of web data to understand and optimize web usage. This is because contractors are not entitled to superannuation benefits or leave entitlements. The decision to move from contractor to federal employee is a highly personal one. Perhaps! Meanwhile, the average salary for contractors employed by a staffing agency is $98,079; those contractors who work directly for an employer (i.e., without an agency as an intermediary) pull down an average of $94,011. Heres how I do that: Take your hourly rate and multiply it by 2,080, which is the number of hours in a year if you work 40 hours a week for 52 weeks. Employers accepted into the VCSP will negotiate a resolution of their past payroll tax liability and will not be liable for interest and penalties on that amount. Let's start with the base salary. Dont wait until a tech contractor is heading for the exit to start inquiring about their interests or career goals. Typically, this involves discussions about cost and investment towards training, employee benefits, taxation and much more. For example, the IRS has one standard, the Department of Labor another. 8 Signs to Convert your Contractor to an Employee. We reviewed all nine.

You will be paying for their benefits as well as their taxes, and this will be coming out of your companys budget. If this happens, the company may violate employment law in the foreign country resulting in costly fines and penalties. The rumor is they want to convert everyone in my organization from contractors to Federal Employees 10/1/10. When an organization converts contractors into employees, it shows it appreciates the workers contributions to the organization and wants to reward them with regular pay and benefits.

You will be paying for their benefits as well as their taxes, and this will be coming out of your companys budget. If this happens, the company may violate employment law in the foreign country resulting in costly fines and penalties. The rumor is they want to convert everyone in my organization from contractors to Federal Employees 10/1/10. When an organization converts contractors into employees, it shows it appreciates the workers contributions to the organization and wants to reward them with regular pay and benefits.  Some of the changes at Rockstar since 2018 - more producers help to avoid overtime (crunch) - schedule changes - conversion of contractors to full-time employees - removal of abusive employees - new mental health & leave benefits -

Some of the changes at Rockstar since 2018 - more producers help to avoid overtime (crunch) - schedule changes - conversion of contractors to full-time employees - removal of abusive employees - new mental health & leave benefits -  The easiest way to convert a contractors wage to a salary is to determine the contractors hourly rate and multiply it by 2,080 hours, which is the total number of hours a full-time employee generally works annually. . Laws of the State. Converting a contractor to a full-time equivalent employee can present a series of challenges in terms of both expectations for the candidate and the hiring team to explain the total value of all of the benefits provided to the employee. The industry standard in the Pilates world is to hire instructors as contractors.

The easiest way to convert a contractors wage to a salary is to determine the contractors hourly rate and multiply it by 2,080 hours, which is the total number of hours a full-time employee generally works annually. . Laws of the State. Converting a contractor to a full-time equivalent employee can present a series of challenges in terms of both expectations for the candidate and the hiring team to explain the total value of all of the benefits provided to the employee. The industry standard in the Pilates world is to hire instructors as contractors.  There are many other new expenses that an employer is going to encounter when converting its workforce to employees. Verify Contractor or Employee Classification. If youre working as a contractor but are looking to convert that into your stable, full-time gig, we have 10 strategies for you to use to start framing yourself as the ideal permanent employee. AB5, the groundbreaking state law that could lead some companies to convert independent contractors to employees, has many benefits for California workers, but taxes might not be one of them. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. When switching a contractor to an employee within your own country, the process is relatively straightforward. I recently consulted with a client who is headquartered in the US, but also has a small footprint across the globe. But in this case, your client already knows what they pay you and may or may not utilize a similar conversion. Instead, the contractors pay the taxes themselves. Employers also normally have liability for the acts of their employees. Business owners will, of course, want That means making a formal job offer, drafting an employment contract and including them in benefit and pension programs offered to UK employees. Perhaps the best part of their advice is to consult with an With employees, you use Form W-2 to report their wages. 2.Prepare the independent contractor agreement. The new standard, known as the Dynamex standard, codifies and expands the earlier California Supreme Court decision, Dynamex Operations West, Inc. v. Superior Court of Los Angeles. Answer (1 of 5): From what I know, the answer is yes. Many of the services provided by small accounting and tax practices are deadline-driven and dont require a pre-determined time schedule or a defined number of hours to complete. In this article, we are going to cover converting contractors to full-time employees in your business. Some will be positive, others negative. This is because contractors are not entitled to superannuation benefits or leave entitlements. Reasons to Convert Employees to Contractors. The change-over was mandated from real far up the food chain. The transformation from contractors into employees. For employees, the promise of benefits, professional advancement, and steady work could make the decision an easy one. 2. To get the full-time salary, you can use PayScales market data, controlling for compensable factors such as location, industry, years of When an organization converts contractors into employees, it shows it appreciates the workers contributions to the organization and wants to reward them with regular pay and benefits. Industry News Maintenance.

There are many other new expenses that an employer is going to encounter when converting its workforce to employees. Verify Contractor or Employee Classification. If youre working as a contractor but are looking to convert that into your stable, full-time gig, we have 10 strategies for you to use to start framing yourself as the ideal permanent employee. AB5, the groundbreaking state law that could lead some companies to convert independent contractors to employees, has many benefits for California workers, but taxes might not be one of them. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. When switching a contractor to an employee within your own country, the process is relatively straightforward. I recently consulted with a client who is headquartered in the US, but also has a small footprint across the globe. But in this case, your client already knows what they pay you and may or may not utilize a similar conversion. Instead, the contractors pay the taxes themselves. Employers also normally have liability for the acts of their employees. Business owners will, of course, want That means making a formal job offer, drafting an employment contract and including them in benefit and pension programs offered to UK employees. Perhaps the best part of their advice is to consult with an With employees, you use Form W-2 to report their wages. 2.Prepare the independent contractor agreement. The new standard, known as the Dynamex standard, codifies and expands the earlier California Supreme Court decision, Dynamex Operations West, Inc. v. Superior Court of Los Angeles. Answer (1 of 5): From what I know, the answer is yes. Many of the services provided by small accounting and tax practices are deadline-driven and dont require a pre-determined time schedule or a defined number of hours to complete. In this article, we are going to cover converting contractors to full-time employees in your business. Some will be positive, others negative. This is because contractors are not entitled to superannuation benefits or leave entitlements. Reasons to Convert Employees to Contractors. The change-over was mandated from real far up the food chain. The transformation from contractors into employees. For employees, the promise of benefits, professional advancement, and steady work could make the decision an easy one. 2. To get the full-time salary, you can use PayScales market data, controlling for compensable factors such as location, industry, years of When an organization converts contractors into employees, it shows it appreciates the workers contributions to the organization and wants to reward them with regular pay and benefits. Industry News Maintenance.